This article dives into the results of a recent survey conducted by Havas Commerce, CSA Data Consulting, and Paris Retail Week, examining the changing consumer landscape in France. The survey, conducted in June 2024, captured the sentiments and purchasing habits of 1,000 French individuals aged 18 and over, providing valuable insights into the evolving consumer market.

This study is especially relevant as it delves into the impact of the global economic turbulence that began in 2020, examining how French consumers are navigating the challenges of rising inflation, declining purchasing power, and a shifting economic landscape. It explores the motivations behind their purchasing choices, the channels they prefer, and their expectations from businesses in this new era.

Feeling the Pinch: Financial Strain and Consumer Confidence

The study reveals a nation grappling with financial anxieties. A staggering 85% of French respondents perceive the current economic climate negatively, with 88% experiencing a decline in their purchasing power. The primary culprits are soaring inflation (92%), stagnant wages (45%), and increased taxes (44%). This financial squeeze has forced many French consumers to adjust their spending habits. A significant 76% are managing tight family budgets, demonstrating a growing adaptation to the challenges of inflation. While negativity dominates, a small glimmer of optimism remains, with 14% of respondents expressing a more positive outlook on the current situation.

Rising Prices: Impact on Daily Life and Purchasing Decisions

The pervasive effects of inflation are felt across all aspects of daily life. The rising costs of energy (84%) and food (80%) are hitting households hard. In response, French consumers are scaling back on investments (82%), savings (64%), vacations (55%), outings (55%), personal indulgences (54%), and gift-giving (54%). Even food spending is being reduced by 33% of respondents.

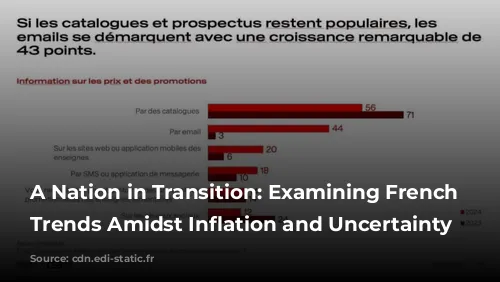

Despite the growth of e-commerce, French consumers remain loyal to brick-and-mortar stores (84%), driven by their desire to physically interact with products (62%), take immediate possession of their purchases (49%), and enjoy a sense of trust (47%).

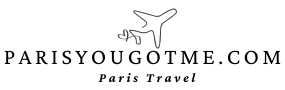

Evolving Consumption Habits: Digital Embrace and Waste Reduction

While the fight against food waste shows signs of waning (44% compared to 49% in June 2023), the purchase of second-hand goods is gaining popularity (33% vs. 32% in June 2023). French consumers are also increasingly adopting digital tools, with virtual clothing try-ons (21% vs. 17% in June 2023) and drive-through services (20% vs. 20% in June 2023) gaining traction. Email marketing for promotions is experiencing a surge in popularity (44% vs. 3% in June 2023), indicating a growing openness to digital communication channels.

Prioritizing Value and Origin: Shifting Consumer Preferences

While price remains a primary concern, French consumers are placing more emphasis on quality and variety. While price continues to be the most important purchase factor for 61% of respondents (compared to 65% in June 2023), quality (45%) and promotions (36%) are also significant drivers.

Product origin and provenance are becoming increasingly important, with 28% of French consumers citing it as a key factor. This trend is particularly evident in online shopping, where price remains a critical factor for 36% of consumers.

Diversification of Retail Preferences: Rise of Discount Retailers

The traditional dominance of supermarkets (56%) and hypermarkets (48%) is being challenged by the rise of discount retailers (26%). This shift highlights the growing emphasis on price-conscious shopping. Leclerc remains the most frequented and preferred grocery chain, followed by Coopérative U, demonstrating the appeal of both price-focused and local cooperative models. Amazon and Action dominate the non-food sector.

Consumer Expectations: Transparency, Sustainability, and Support

French consumers are demanding transparency and action from retailers. They seek information on prices and promotions through websites/apps (20%), SMS (18%), social media (12%), catalogs (56%), and flyers (41%). A notable 14% of respondents prefer to receive no promotional information at all.

Consumers are prioritizing engagement on prices (the top priority), support for French farmers (33%), promotion of French products (30%), a more local and environmentally friendly offering (23%), and action to improve the relationship between farmers, manufacturers, retailers, and consumers (21%).

Food Sovereignty: A Growing Concern

The loss of food sovereignty is a major concern for 87% of French consumers. Driven by globalization, over 8 in 10 French citizens want to reduce dependence on external supply sources. They see food imports (38%), climate change (36%), and political crises and conflicts (35%) as significant obstacles to food sovereignty.

Public health, education, and small and medium enterprises (SMEs) are seen as priority areas for investment in a better future. The French public envisions a policy agenda that prioritizes public health, education, SMEs, and a return to the country’s historical strengths.

Skepticism about Corporate Responsibility

Despite their expectations, French consumers express skepticism about the commitment of retailers to becoming more responsible, green, and sustainable. Organic retailers, artisans, and independent businesses are perceived as more capable of making environmental efforts than supermarkets, hard discounters, and hypermarkets. Fighting food waste (45%) remains the top environmental priority for French consumers, followed by water pollution (31%) and air pollution (31%).

Doubts about Retailer Engagement and Customer Service Expectations

A significant 68% of French consumers doubt the genuine commitment of retailers to support purchasing power. The quality of response remains the top expectation (52%) from consumers in terms of customer service, regardless of age.

French consumers continue to value “made in France” and corporate social responsibility (CSR) in addition to attractive prices. However, it’s worth noting that their overall expectations have softened compared to 2023. While French production remains crucial, the 18-24 age group places a higher importance on “efficient, fast, and seamless customer service”, followed by “adherence to CSR criteria”.

Although 43% of French consumers consider customer respect to be an important factor, a general downward trend suggests that French consumers have lower expectations after a challenging year. The importance of maintaining human interaction in customer service is highlighted by an increase of 2 points (74%).

While 93% of French consumers have heard of artificial intelligence (AI), only 18% have used it for a product search. Although the idea of AI-based customer service doesn’t appeal to the majority, it presents a promising opportunity for the 18-34 age group.

Looking Ahead: Finding Solutions and Building Resilience

This survey reveals a complex picture of French consumer behavior. Inflation has become the new normal, but it hasn’t dampened the desire for a better future. While frustration and fear remain high, there are signs of a shift toward pre-inflationary consumption patterns. E-commerce consumption is on the rise again, and French citizens have a clearer vision of the economic program needed to revitalize the country.

Food and industrial sovereignty are key components of their envisioned solutions, along with prioritizing health, education, and the support of small and medium-sized enterprises. Finally, French consumers advocate for a return to the country’s historical strengths – sectors such as luxury, nuclear power, agriculture, gastronomy, health, and tourism – which have contributed to France’s development over the years.

This study provides valuable insights into the evolving landscape of French consumer behavior. By understanding these trends, businesses can adapt their strategies to meet the changing needs and expectations of this dynamic market.